All Categories

Featured

Consider Making use of the cent formula: dollar means Debt, Earnings, Home Loan, and Education. Total your financial obligations, home mortgage, and university expenses, plus your wage for the number of years your family needs security (e.g., until the youngsters run out your house), and that's your protection demand. Some financial specialists compute the quantity you require utilizing the Human Life Value philosophy, which is your life time income prospective what you're earning currently, and what you expect to gain in the future.

One method to do that is to search for companies with solid Financial stamina scores. term life insurance for parents. 8A firm that finances its very own plans: Some companies can sell plans from another insurance company, and this can include an extra layer if you intend to transform your policy or down the roadway when your household requires a payout

When Does A Term Life Insurance Policy Matures

Some business offer this on a year-to-year basis and while you can expect your prices to increase considerably, it might be worth it for your survivors. An additional method to compare insurance policy firms is by looking at on-line consumer evaluations. While these aren't likely to tell you much concerning a business's economic stability, it can inform you just how easy they are to collaborate with, and whether cases servicing is a problem.

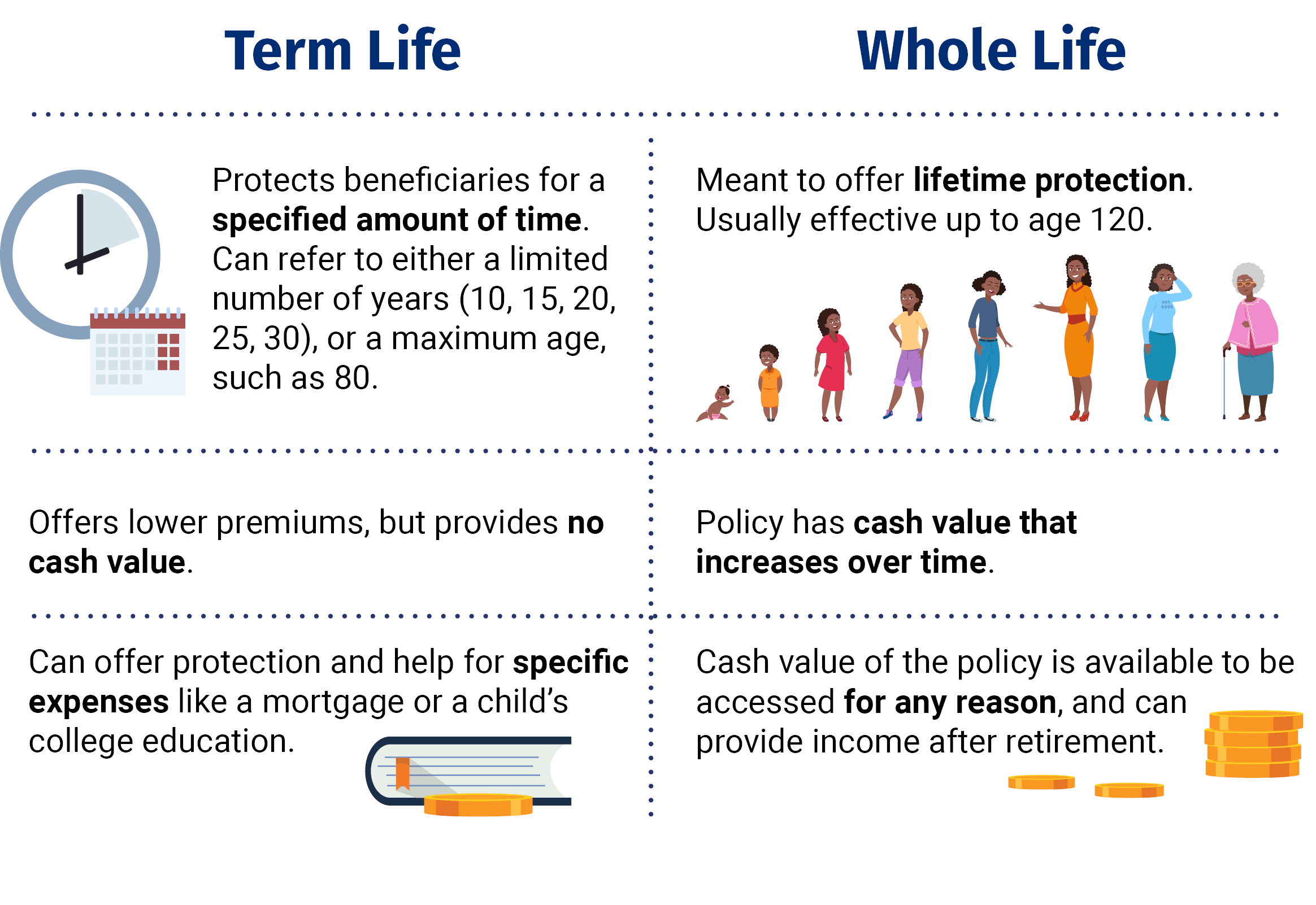

When you're more youthful, term life insurance can be a basic means to secure your liked ones. As life adjustments your financial top priorities can also, so you may want to have entire life insurance for its life time coverage and additional advantages that you can use while you're living.

Authorization is ensured despite your health and wellness. The costs will not enhance as soon as they're set, yet they will certainly rise with age, so it's a good idea to lock them in early. Discover even more about how a term conversion works.

1Term life insurance policy provides short-lived defense for an essential period of time and is usually cheaper than irreversible life insurance policy. one disadvantage of term life insurance is that. 2Term conversion standards and restrictions, such as timing, might use; for example, there might be a ten-year conversion opportunity for some products and a five-year conversion privilege for others

3Rider Insured's Paid-Up Insurance Acquisition Option in New York City. 4Not readily available in every state. There is a price to exercise this rider. Products and cyclists are available in authorized jurisdictions and names and attributes might differ. 5Dividends are not guaranteed. Not all participating policy owners are eligible for rewards. For pick cyclists, the condition puts on the guaranteed.

Latest Posts

Term Life Insurance Hong Kong

American Memorial Burial Insurance

Which Of The Following Is Not True About Term Life Insurance?